Articles

As a result of the highest volatility, payouts require some perseverance, nevertheless when they takes place they are very big. Playing, click on the ‘Wager Real money’ key you need to take to the best-rated on-line casino that have Couch potato in collection, or comprehend the gambling enterprise ratings to decide your preferred internet casino. All of that said, there is certainly often almost no prices to including one to inflation protection, centered on the thing i find in my lookup.

Use this ranking because the a hack in order to choose the newest companies that supply the better investment possible now,… That it party out of advantages helps Money Strategists take care of the highest top from reliability and you may reliability you’ll be able to. To possess suggestions around the newest registration status of eleven Economic, please contact the official bonds bodies for those states where 11 Economic maintains an enrollment submitting.

Exactly how many of you was settee potatoes you to successfully turned their lifestyle as much as?

Let’s think particular methods for you to combine investment allotment ETFs and most other things rather than completely losing simplicity. Because the consequences start working, you will probably have the most effective feelings inside first 2 so you can 4 days. That’s where the fresh psychoactive consequences, leisure, and you will changed effect try most noticeable.

How come passive using compare with productive using?

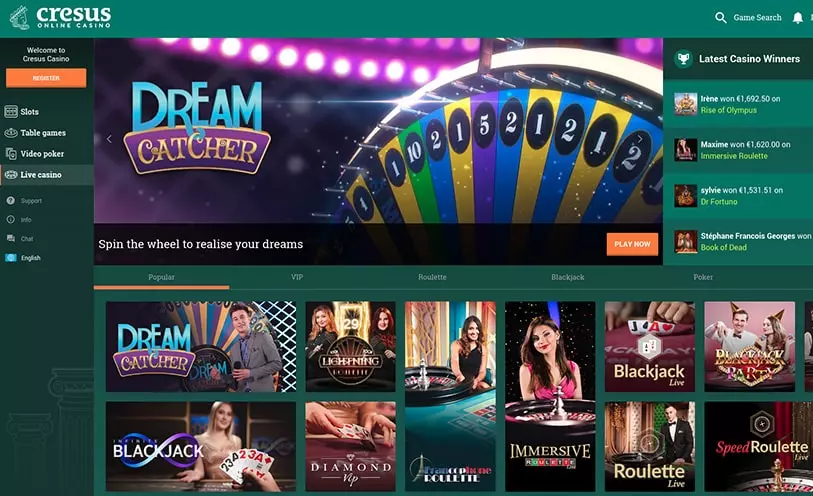

You might wager real money during the an online gambling enterprise otherwise free of charge that have a demo adaptation. As mentioned, here commonly of several couch potato signs, you could increase your probability of successful by the gaming around three gold coins. It must be indexed that should you do that, minimal bet assortment goes away from 0.25 to 0.75 coins. Like other old-fashioned harbors, this video game cannot provide a plus bullet or 100 percent free revolves.

Since the before, the three profiles the have quite lower MERs and have a a good level of possessions under management. An extra foundation impacting corporate ties, otherwise securities given by the companies, are a prospective credit downgrade. In the event the a family is analyzed to be riskier than just it actually was just before, their ties usually typically miss inside well worth. Once more, the three all-in-you to profiles required from the Canadian Couch potato have quite lowest MERs and have a lot of assets below management. Even if Canadian Couch potato isn’t an asset director, the site recommends lowest-rates ETF alternatives from high funding managers including Leading edge, Blackrock, and BMO.

There’s a capture-22 against of many create-end up being traders you to definitely’s remaining them outside of the business. On the one-hand, they feel they lack the economic knowledge to https://happy-gambler.com/red-stag-casino/ handle their particular opportunities with confidence. Simultaneously, they wear’t need to rely on the advice provided by financial advisors, who often have an excellent vested need for attempting to sell products which spend them the greatest administration otherwise trading fees.

I will remember that the fresh rising prices-assaulting possessions—such as merchandise, gold and you may item stocks—may possibly not be required when you’re on the accumulation stage, meaning you’lso are increase the collection. Over long episodes out of 15, two decades or even more, stock areas are making a wonderful inflation hedge. In the retirement, otherwise once we strategy the fresh retirement risk zone, avoiding near-name rising cost of living dangers is important. As the general premises of one’s Couch potato remains the exact same, a great deal has changed as the MoneySense introduced the methods so you can Canada some 22 years ago.

- Although not, in case your couch potato collection manages to lose quicker, moreover it development quicker.

- Couch potato using brings people that have a good diversified portfolio of list fund or ETFs.

- On the flip side, Bitcoin’s dominance is found on a serious upswing, matching their price rise.

- Be careful you to highest-chance ties manage are present however they are impractical becoming utilized in all-in-one collection alternatives like these.

Do i need to Return Which have a settee-Potato Collection?

This informative article really should not be felt over, cutting edge, and that is maybe not supposed to be utilized in place of an excellent see, consultation, otherwise information from a legal, medical, or any other professional. I usually believe it had been a mention of the the brand new random stray chips your possibly discover lodged regarding the couch cushions. He is constantly receive somewhere on the/on the chair…..because the would be the those who observe tv all day long. This is how they chanced to take place, considering an enthusiastic depicted background because of the two of the perpetrators by themselves, «Elders» Jack Mingo and Robert Armstrong, from the Formal Inactive Handbook (1983).

Various other error is using the phrase also broadly – just because someone provides relaxing on the couch occasionally doesn’t suggest it’re also a full-fledged passive. One to word to own “couch potato” try “lazybones,” which suggests deficiencies in inspiration or hobby. Various other similar identity are “slacker,” which suggests somebody who stops work or responsibility. At the same time, an enthusiastic antonym to own “passive” might possibly be someone who are active and you can active, including an exercise lover or activities lover.

After you’ve just snuggled to your enjoying indent on your own sofa, their Netflix waiting line is piled, your food is in this arm’s come to, and you will become the position simply melting away such as butter to the sensuous toast? Now, group, that’s everything i label the new essence of being a real settee potato. However, wear’t be misleading, my personal precious spudlings, it’s a lot less straightforward as it sounds. Inside chart, i’ve a glance at the cutting-edge profile designs during the about three chance profile.

Such as the rest to your the number, the fresh profiles are also fund-of-money. ETFs give you for example choices, along with expertise thread money built to get rid of income tax in the event the held inside non-entered account. Knowledgeable traders also can explore U.S.-noted ETFs, that will even be a lot more tax-effective. The couch Potato method is simple for those who’re also investing tax-sheltered membership for example RRSPs and you will TFSAs. But when you provides an enormous non-inserted (taxable) membership, the simplest alternatives don’t be as effective as. Now you you need more freedom to make certain your own profile is made within the an income tax-efficient way.

Roboadvisors often build profiles having energetic procedures—possibly on the side, sometimes overtly—because the Lime technique is far more passive. Both options provide comparable benefits and you will equivalent can cost you, after you add the roboadvisor’s own fee (usually 0.50percent) on the cost of the underlying ETFs. Through the years, the brand new cousin sized for each and every nation’s stock-exchange often progress. Including, now the usa makes up about nearly 58percent of your around the world security business, however, since the has just while the 2018 one number are closer to 43percent. The new Tangerine Around the world ETF Portfolios can be expected to shift its asset allocation over time to help you echo transform in this way. While the Worldwide ETF Portfolios are bought and you may bought in Canadian bucks, he’s got considerable connection with foreign currency.

The brand new monetary mass media is hyper-worried about small-label industry information, financial predicts, and you will self-curious benefits who can create their best so you can divert you against their a lot of time-term package. List using, in particular, can be designated as the naïve, actually stupid—oftentimes from the currency professionals that have spent many years lagging those individuals same list financing. Don’t underestimate exactly how tough it could be to withstand these interruptions. The fresh list supplier S&P produces a normal scorecard one compares the brand new performance out of positively treated shared finance international so you can suitable indexes. More any kind of significant months, merely a little minority from fund outperform. Most investors just remember that , bond cost slide when output increase.

What’s quicker notorious is the fact bond ETF rates have a tendency to refuse steadily whether or not interest rates don’t changes. That’s while the just about all the newest ties inside the a general-dependent ETF now were purchased at a premium—to put it differently, for over par value. Since these bonds adult otherwise get ended up selling, the brand new finance have a tendency to incur a steady trickle of short money losings. But one to doesn’t indicate your investment seems to lose money full, while the desire payments in the securities usually counterbalance at least certain those individuals losings. Undoubtedly, it’s an entire fluke that i checked inactive profiles that have inflation fighters only weeks ahead of rising prices and you will stagflation reared the ugly minds.